You must have read a number of times that it’s best to buy a term-insurance policy early in life to avail of cheaper premium rates.

However, cheaper rates should not drive your decision to choose a particular policy as you may not always get the best deal.

The primary reason for buying a term cover should be to take adequate insurance, which should be done through a reliable company.

Term insurance is a pure risk cover taken for a specific period of time. It pays benefits to the nominees of the insured only if the insured dies within that specific period.

If he/she lives beyond that period, no benefits are payable. The premiums on term insurance are much affordable but rise as the person ages.

There are a few things an individual needs to look into before buying a term cover. As the person’s age increases, his/her family responsibilities widen.

The accompanying table shows how premiums keep increasing if the term cover is not bought at a right age, which is when the individual starts earning.

“For individuals who are financially independent with no liabilities, a cover at least 10 times of their annual income could be adequate. But with increasing obligations and assets, he needs to analyse and accordingly take a cover,” says Harsh Roongta, CEO, Apnapaisa.com.

Buying it online:

Buying an insurance policy is definitely cheaper as the agent commissions and distribution costs are almost negligible.

However, if a person buys a product online, it’s his responsibility to initiate the entire process and see that claim settlement is not too tedious for his family on his death. Because on settling the claim, there is no intermediary between the insured and the company, which one may find difficult to track.

Though in term cover, the online settlement of claims should be an easy process, it may still be strenuous as the family has to do all the documentation.

On the other hand, the agent is usually very alert and keeps a track of the slightest change that is required in the policy.

“Since insurance is a push-product, unless an agent explains the product in depth, it is never bought by the customer. Policy servicing and claim settlement are also better managed by an agent, who updates your policy regularly. Thus it’s difficult for insurance to sell online.” says GV Nageswara Rao, managing director & chief executive officer, IDBI Federal Life Insurance Co Ltd.

Also, the policy needs to be kept updated regularly. For example, job change requires the policy to be updated, because if your premiums are auto-debit from your salary account and you forget to intimidate your insurer about your new salary account, then in such a case the policy may lapse and you will have to start a new policy all together.

Some people don’t mind paying the agent commissions as long as their policy is getting regularly serviced, rather than getting their policy lapsed for such minor reasons. One has to be very alert about his policy if taken online.

“Buying an insurance policy online is 10-15% cheaper than the offline rates, because of various factors like cut in agent commissions, rent & office expenses.” says Elizabeth Venkataraman, CMO of Kotak Mahindra Old Mutual Life Insurance.

Secondly, one has to be an internet savvy as it requires one to pay premiums and complete all the formalities.

Also the paperwork is not reduced as you are still expected to submit the required documents Insurance companies usually send their agents to collect the documents, but not all may provide an agent who could assist you for your medical tests.

Death claim repudiation ratio:

One can get this information on the Insurance Regulatory & Development Authority website. The denial claim ratio tells us the percentage of claims settled by a company. But one cannot take a negative view about companies based on the ratio. At times, it’s also the customer who does not disclose all the information related to his ailments to avoid higher premiums. In such cases, the company may refuse to pay claims on death for not disclosing information about his health.

But across the industry, the insurance companies have to pay claims even if the person has not disclosed certain ailments but has completed two years of buying the policy.

Also, insurance should be bought from a company which has a good brand name and reputation.

For example, there is a difference of Rs4,000 in premiums of Met Life which is an online product against State Bank of India which makes lowest premiums available through their agents.

“Met Life has a denial claim percentage of 25% whereas SBI has it close to 5%. This means Met Life has managed to settle death claims of up to 75% whereas SBI has done it close to 95%. Only Birla Sun Life, LIC, ICICI Prudential Life Insurance, HDFC Life and SBI Life have claims ratios close to 5%,” said Roongta.

For example, LIC’s term plan might look very expensive but it holds a very good claims denial ratio, which should be of utmost importance to the buyer.

Mortality:

The term-cover premium may vary from company to company also because the main reason being its mortality rate risk. Mortality rate is the number of deaths occurred in a specified age group and time period.

For example, Birla Sun Life offers Rs50 lakh cover for an annual premium of Rs11,650, whereas Reliance Life Insurance offers the same cover at Rs19,652.

“The difference in mortality rate is because every company has a different set of customer profiles and many companies don’t even update their old figures regularly. This can also be a reason why LIC has the most expensive term plan in the market.” says Suresh Sadagopan, who runs Ladder 7 Financial Advisories.

The life expectancy is higher in high income groups as they have access to good healthcare solutions.

Thus, the mortality rate and risks associated with their lives is lesser, resulting in lower premiums against the companies have higher mortality rates.

In case of term covers, the premiums charged are inclusive of the mortality rates and are not shown separately as they are shown in unit-linked insurance products.

Source : http://www.dnaindia.com/money/1502355/report-cheaper-term-cover-may-not-be-the-best-deal

Tuesday, November 26, 2013

Sunday, November 3, 2013

LIC’s Bonus rates for 2013-14

LIC declared it’s bonus rate on 6th September 2013. So let us see some big movers and changers this year.

For more infor, visit : http://basunivesh.com/2013/10/25/lics-bonus-rates-for-2013-14-and-comparision/

For more infor, visit : http://basunivesh.com/2013/10/25/lics-bonus-rates-for-2013-14-and-comparision/

You Passport Application Status online

Now, you can track you Passport Application status online by visiting : PASSPORT STATUS ONLINE

IRDA Life Insurance Regulations 2013

Recently IRDA revamped so many changes when it comes to Life Insurance. All these changes will be effective from 1st October 2013 (Now IRDA extended it to 1st Jan 2014) . It is very important for all Life Insurance buyersto understand these changes well before going ahead for any buying.

Non Linked Regulations-

- Non Linked products like traditional life insurance policies will be classified as “PARTICIPATING PRODUCTS OR “PAR PRODUCTS” and NON-PARTICIPATING PRODUCTS OR “NON-PAR PRODUCTS” .

- PAR PRODUCTS will be eligible for Bonus on annual basis + Interim Bonus + Final Additional Bonus.

- Minimum Death Benefit will be A) For Single Premium it is 125% for age up to 45 years, 110% for others. B) For Non Single Premium it is minimum 10 times of the annualized premium (for age up to 45 years), for the rest it is 7 times of annualized premium.

- For Non Single Premium it is minimum 10 times of the annualized premium (for age up to 45 years), for the rest it is 7 times of annualized premium.

- The minimum policy term will be 5 years and minimum premium paying term for non single premium policies will be more than 5 years.

- Guaranteed Surrender Value (for regular premium policies) will be as below. A) 30% of premium paid less any survival benefit already paid, if surrendered within 2nd Or 3rd Year. B) 50% of premium paid less any survival benefit already paid, if surrendered within 4th To 7th Year. C) 90% of premium paid less any survival benefit already paid, if surrendered in the last 2 years of policy , if term of the policy is less than 7 years.

- Premiums will be equal throughout the period of the policy.

Monday, October 28, 2013

What India's job hunters must know right now

Are you looking for a job? Do you want to know where the jobs are right now? Then you might soon confirm your interview and get hired in one of the country’s bright spots.

For more info, visit : http://in.finance.yahoo.com/news/what-india-s-job-hunters-must-know-right-now-075401825.html

For more info, visit : http://in.finance.yahoo.com/news/what-india-s-job-hunters-must-know-right-now-075401825.html

Sunday, October 27, 2013

5 major changes in life insurance policies from Jan 1, 2014 – How it affects you ?

Some major changes are going to happen in life insurance industry from Jan 1, 2014, especially in traditional policies like Endowment Plans, money-back plans and even ULIP’s. You will surely have a LIC policy or any other private sector traditional plans or might buy them in coming times. Here are 5 major changes which you should be aware about and they will come into effect from Jan 1, 2014.

1. Service Tax introduced in LIC Policy Premium

Till now LIC was not charging the service tax of 3% from the customers and paying it to govt from the pool of money collected itself, but now the service tax will have to be charged separately from policy holders. Which means that if your LIC premium was Rs 50,000 per annum, now it will be 3.09% higher in first year, which is Rs 51,500 and after 1st year, it will be 1.545% as per moneylife article.

While customers see it as additional burden, note that its not the case exactly, Earlier – LIC was paying the service tax from the pool of money collected from investors only, which reduced the bonus amount given back to them. But now because it will not be taken out from the funds, that means the bonus declared each year will go up by that much margin and will come back to investors only. Note that Pvt companies were charging the service tax already, so nothing changes on their side. Only LIC was not charging it separately, which they will have to do from Jan 1, 2014 deadline.

2. Increase in Surrender Value

One of the major changes which has happened, is the change in surrender value for policy holders. The rules of surrender value depends on the premium paying term of the policy. If the premium paying term for policy is less than 10 yrs. Then the policy will acquire the surrender value after paying premium for 2 yrs (earliar it was 3 yrs), however if the premium paying tenure is more than 10 yrs , then the surrender value will be acquired only after paying 3 yrs premium.

In both the cases, the minimum surrender value would be 30% of the premiums paid without excluding the first year premium. Note that earlier, if you used to surrender after paying 3 premiums, you got 30% of premiums paid MINUS first year premium, but now as per new rules, the first year premium will not be deducted. Learn everything about LIC policies working before Oct 1

Another good change is that, from 4th-7th year, the minimum surrender value would be 50% of the premiums paid, and has to reach 90% of premiums paid in last 2 yrs of policy paying tenure.

3. Possible Decrease in Premium on LIC Policies

There is a great possibility that the premiums on LIC policies will come down by some margin, because the mortality rates will now be revised by LIC in calculating the premiums.

Mortality rates are the rates at which the insurance company deducts the fees for insuring you based on your age. LIC had been using old mortality rates till now, but now they will have to use new mortality rates . Just to give you an idea on reduction of premium, when I check the mortality rate for a 40 yrs old person in old table, its 0.001803 . But in new rates its 0.002053 . Which is approx 10% better. Lets not go into detailed calculation at the moment, but your risk premium part should go down by 10% (not the full premium, because only some part of whole premium in traditional policies are risk premium and rest is investment part) .

4. Higher Death Benefit

If the policy holder is above 45 yrs of age, then the Sum Assured has to be more than 10 times the annual premium, and for those who are less than 45 yrs old, it can be minimum 7 times the premiums. Note that for claiming the tax exemptions, your sum assured has to be 10 times the base yearly premium. So when you buy the policy in-case, you need to keep it in mind.BasuNivesh has done a great point by point notes on each aspect of regulation, in-case you want to go into details.

5. Agents’ incentives have now been linked to the premium paying term

Now agents commissions is linked to the premium paying tenure. Earlier a lot of agents used to sell the policies which had higher maturity tenure, but limited premium paying tenure (like 30 yrs policy with 10 yrs premium payment) . Here is the

For more info, visit : http://www.jagoinvestor.com/2013/09/5-major-changes-in-life-insurance-policies-from-oct-1-2013.html#.UmzOyPmvDZE

LIC Housing Finance floats two new home loan products

New Delhi: Indian mortgage lender LIC Housing Finance said that it has introduced two home loan products, Bhagyalaxmi Plus and New Fixed 10.

Bhagyalaxmi Plus is aimed at women seeking to become the sole owner of a property, LIC Housing Finance said in a statement.

Under this scheme, the lender is offering a fixed interest rate of 10.35% for loans up to Rs 7.5 million for the first two years, the statement said. The interest rate will then be linked to the floating rate, it added.

Besides, customers availing loans under this scheme will be provided a discount of 0.25% throughout the loan term on conversion to floating rates.

For more info, visit : http://in.finance.yahoo.com/news/lic-housing-finance-floats-two-113311109.html

Friday, October 25, 2013

Tuesday, October 22, 2013

How to calculate interest on credit card balance?

For more, Visit : http://basunivesh.com/2013/10/21/how-to-calculate-interest-on-credit-card-balance/

One of the easiest way of shopping these days is by using our credit cards. Reason is, we buy now but pay later. But at the same time have you noticed or understood the way the interest is calculated on such transactions? We hardly take notice of the calculation method used.

Reason for such neglect is, we mainly concentrate on terms such as billing cycle, grace period we get, minimum balance amount or the annual charges. But forget to notice the rate of interest or the method of interest calculation. Hence it is better to understand it. I try to simplify it with a simple example.

In India lot of card providers usually use the method of calculation called Average Daily Balance Method. Here in this method of calculation each day’s transaction will matter most for calculating interest on how much you owe. Let us say Mr. Arun has an XYZ bank credit card. Billing cycle will be 30 days. Assume annual interest levying will be 24%. He started the billing cycle with the balance of Rs.25,000. On the 10th day of the billing cycle he purchased some household goods worth of Rs.8,000. On the 20th day of the billing cycle he paid an amount of Rs.10, 000 to your credit card billing cycle. Now calculation will be done in below steps.

1) Calculating the average balance for the 30 day period.

From 1st day to 9th day balance is Rs.10,000. So we need to add this balance for the 9 days like Rs.10,000+Rs.10,000+Rs.10,000+Rs.10,000+Rs.10,000+Rs.10,000+Rs.10,000+Rs.10,000+Rs.10,000=Rs.90,000.

From 10th day to 19th day of billing cycle the balance will be Rs.10,000+Rs.5,000=Rs.15,000. So total balance for the period will be Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000+Rs.15,000=Rs.1,50,000.

From 20th day to 30th day of billing cycle the balance will be Rs.Rs.15,000-Rs.7,000=Rs.8,000. So total balance for the period will be Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000+Rs.8,000=Rs.88,000.

Now the total average balance will be (Rs.90,000+Rs.1,50,000+Rs.88,000)/30 days=Rs.10,933.

2) Divide the number of days in a year into billing cycle days. In this case billing cycle is for the period of 30 days. Hence 30/365=0.0821.

3) Multiply this 0.0821 factor with annual interest chargeable on credit card i.e. 24% . So it is (0.0821)*(0.24)=0.197.

4) Final step will be multiplying this interest to his daily average balance, i.e. (0.197)*(Rs.10,933)=Rs.2,154. This will be the interest Mr.Arun need to pay.

The same step can be achieved by putting appropriate values in below formula.

Average daily balance method for credit card=(days in billing cycle/365) (Annual Percentage Rate) (Average Daily Balance).

But do remember that while calculating this average daily balance, few banks adds charges made during the month. If they add so then your average daily balance will increase. In return you need to pay higher interest. Hence make sure what type of calculation they are doing.

Sunday, October 20, 2013

Sabarimala Temple Darshan Tickets Online booking

How to book your online tickets for E-queue at Sabarimala Temple

Things you need to book the tickets online

1) Your scanned passport size photo must be in jpg / jpeg and size below 30 KB.

2) Identity Card – can be any one of these - Election ID Card, PAN card, Ration Card, Driving License, Passport, Educational ID card, Employee ID Card.

Go to : Sabarimala Darshanam

Things you need to book the tickets online

1) Your scanned passport size photo must be in jpg / jpeg and size below 30 KB.

2) Identity Card – can be any one of these - Election ID Card, PAN card, Ration Card, Driving License, Passport, Educational ID card, Employee ID Card.

Go to : Sabarimala Darshanam

Monday, October 14, 2013

LIC is best - why?

The article by V.K. Shunglu in

The Hindu

, “The risk business needs better cover” (Op-Ed, February 14, 2013) is

one-sided and conspicuously understates certain key aspects of insurance

reforms undertaken in the country a decade ago. It misses the basic

premise on which an insurance business is run — that of “trust” and the

long-term “promises to be upheld.”

This industry

should not be seen merely in economic terms. The settlement of the death

claim of Hemant Karkare, chief of the Mumbai Anti-Terrorist Squad, who

was killed in Mumbai’s 26/11, presents a clear-cut example of Trust.

Mumbai’s

Dadar branch of the Life Insurance Corporation (LIC) had settled the

death claim amount of Rs.25 lakh within five days whereas a private

company (name withheld), where Karkare had coverage for a similar

amount, had rejected the claim — and, after a lapse of six months — by

stating that the deceased had wilfully risked his life, even after

knowing that his life was in danger. That’s why I said the insurance

business should not be seen in purely economic terms.

The

tag of public sector should not be the reason for spewing venom. There

are certain “Crown jewels such as LIC”; it settles 98.6 per cent of

claims, the only insurance company in the world to do so. It is true, as

Mr. Shunglu says, that the insurance business has become a key player

in underpinning the long-term foundations of India’s capital markets and

financial system. But for satiating the needs of India’s capital

markets, these private insurance companies have done little good for

gullible policyholders and their hard-earned monies.

This

is an industry in which even with a small amount of investment i.e.

Rs.100 crore, thousands and lakhs of crores of public money can be

garnered. It is firmly believed that the Foreign direct investment (FDI)

hike will allow foreign capital with small investments to gain greater

access and control over large domestic savings. The annual report

(2011-2012) of the Insurance Regulatory and Development Authority (IRDA)

points out that FDI brought in by private life insurance companies up

to March 31, 2012, was a meagre Rs.6,324.27 crore, which was to meet

share capital requirements prescribed by the regulator. Not a single pie

was invested in the infrastructure sector. It is LIC which is a

saviour, and the government of the day is utilising it as a captive

investor, just as it has done in the case of petroleum major ONGC.

In

our country, insurance companies are mopping up people’s savings.

During 2011-12, domestic savings were 32 per cent of GDP. Financial

experts say that domestic savings, and not FDI, are crucial for any

country’s economic development. In India, LIC has provided Rs.7,04,151

crore to the 11th Five-Year Plan (2007-2012) while the four general

insurance companies and GIC of India have contributed about Rs. one lakh

crore. Where will the government get these huge investments from if it

tries to weaken the public sector insurance companies?

The

World Economic Forum Financial Development Report 2012 tells the

success story of LIC. It shows that given the low level of income and

low disposable income of most Indians, insurance penetration in India is

much greater than in countries with a per capita income that is 10

times higher. It is remarkable that with a per capita GDP of $1,388.80,

India has achieved a life insurance penetration of 3.61 per cent as

against 3.56 per cent of the United States with a per capita GDP of

$4,8386.77. It is also a matter of pride that the report places India at

the top of global rankings in terms of Life Insurance Density (measured

as a ratio of direct premium to per capita GDP of 2011).

The

LIC, the four general insurance companies in the public sector and GIC

of India are doing an excellent job despite competition from private

insurance companies. In 2011-12, LIC earned a premium of Rs.81,514.49

crore registering a market share of 71.36 per cent in premium income. It

sold 3.57 crore new policies, to take an 80.9 per cent market share in

the number of policies. Similarly, the four insurance companies have

earned a premium income of Rs.30,532 crore and registered 58 per cent of

market share.

The financial crisis in the U.S. and

Europe has seriously eroded confidence in the banking and insurance

sectors. At the same time, our domestic private insurance partners

hardly need capital to be infused by their foreign counterparts, as put

forth by the votaries of FDI increase.

Partners of

private insurance companies in India like the Tatas and Reliance are on

an acquisition spree, spending billions of dollars, both on the domestic

and foreign fronts during the last five years. The others, like the

State Bank of India and other public sector banks have capital reserves

of their own. Some foreign partners have exited not due to a delay in

the increase of FDI cap but because they are in search of greener

pastures.

The author has also put forth another

interesting argument — that shareholders and company boards be left free

to determine whether additional investment should be through FDI or FII

or by other means.

The world saw the bubble burst in

2008 due to such flawed and mistaken judgements by company boards and

shareholders, when they invested the earnings/savings of innocent

policyholders into Collateralised debt obligations, or CDOs. India was

saved from such a situation because of the domination of the public

sector in the banking and insurance sectors. Even the Prime Minister and

the Finance Minister have shared this view.

Looking

back, it is time to learn lessons from the global collapses of banks,

insurance companies and other financial institutions like Lehman

Brothers, etc. Foreign investment per se, does not bring any good with

it, especially in fragile sectors like insurance. This sector is the

pillar of any upcoming and growing economy.

(M.S.R.A. Srihari is a former joint secretary, Insurance Corporation Employees Union, Warangal division. E-mail:

msra.srihari@licindia.com

)

Read more at : http://www.thehindu.com/todays-paper/tp-opinion/yes-insurance-needs-better-cover-but-not-with-foreign-capital/article4453695.ece

Sunday, October 13, 2013

Non-Residents Eligible For Lower Tax Rate On Capital Gain – HC

Petitioner, a private limited company registered in Scotland. Petitioner during the period relevant to the assessment year 2010-11 had transferred 4,36,00,000 equity shares of Rs.10/- each of Cairn India Limited to Petronas International Corporation Limited, Malaysia for consideration of US$ 241,426,379. This transaction dated 12thOctober, 2009, pursuant to an agreement dated 14th October, 2009, was an off market transaction i.e. not through a stock exchange.

For more, details visit : http://taxguru.in/income-tax-case-laws/nonresidents-eligible-tax-rate-capital-gain-hc.html

The ongoing debt issue of Shriram Transport Finance Company today i.e. October 14, 2013.

Chennai: Shriram Transport Finance Co. Ltd, the country’s largest truck financier, has decided to prune its plans to raise Rs 2,000 crore by selling non-convertible debentures (NCDs) because of uncertainty on interest rates and flat growth in the sales of heavy trucks.

Initially, the company plans to raise Rs 300 crore, less than the Rs 500 crore it had decided to raise earlier. “We will raise only Rs 300 crore with an option to retain over-subscription up to Rs 300 crore as we currently have sufficient resources,” Umesh Revankar, managing director of Shriram Transport Finance, said in an interview.

Friday, October 11, 2013

Raising investment limit of LIC is 'imprudent': IRDA chief

Mumbai:

Insurance Regulatory Development Authority (Irda) chairman J Hari

Narayan today said the government's recent move to allow the state-owned

insurer, LIC, to invest up to 30 per cent in a company was imprudent.

He also said it is a matter of legal interpretation. "I think, it is imprudent," Mr Narayan told reporters on the sidelines of an Insurance Brokers Association of India event.

"Our interpretation was that LIC should be treated at par with all other private insurers. But the government was of the view that there were certain provisions, only applicable to LIC (as per LIC Act). So, it's a question of legal position," he said.

The government has allowed LIC to invest up to 30 per cent in a company against the existing norm of 10 per cent as stipulated in the Insurance Act, 1999 after the Law Ministry clarified that LIC Act, 1959 supersedes the Insurance Act, 1999.

The government is likely to notify the new rules soon.

Referring to the autonomy of regulators, Irda chief said the regulator has enough autonomy and the present issue of difference in approach to LIC case was a matter of legal position.

Meanwhile, he said the board of the Insurance Advisory Council would meet shortly to discuss the new product design guidelines.

"The product design guidelines have been examined by the council. They now have to be approved by the board and they are meeting on January 9," Narayan said without divulging any details regarding the proposed guidelines.

He also said management expenses of the insurance industry in the country were one of the highest in the world and needed a relook.

For more, visit : http://profit.ndtv.com/news/economy/article-raising-investment-limit-of-lic-is-imprudent-irda-chief-315658

He also said it is a matter of legal interpretation. "I think, it is imprudent," Mr Narayan told reporters on the sidelines of an Insurance Brokers Association of India event.

"Our interpretation was that LIC should be treated at par with all other private insurers. But the government was of the view that there were certain provisions, only applicable to LIC (as per LIC Act). So, it's a question of legal position," he said.

The government has allowed LIC to invest up to 30 per cent in a company against the existing norm of 10 per cent as stipulated in the Insurance Act, 1999 after the Law Ministry clarified that LIC Act, 1959 supersedes the Insurance Act, 1999.

The government is likely to notify the new rules soon.

Referring to the autonomy of regulators, Irda chief said the regulator has enough autonomy and the present issue of difference in approach to LIC case was a matter of legal position.

Meanwhile, he said the board of the Insurance Advisory Council would meet shortly to discuss the new product design guidelines.

"The product design guidelines have been examined by the council. They now have to be approved by the board and they are meeting on January 9," Narayan said without divulging any details regarding the proposed guidelines.

He also said management expenses of the insurance industry in the country were one of the highest in the world and needed a relook.

For more, visit : http://profit.ndtv.com/news/economy/article-raising-investment-limit-of-lic-is-imprudent-irda-chief-315658

US shutdown to hit exports; pharma, IT see no immediate impact

Indian exports face additional costs due to delays at ports and

airports in the US in the wake of government shutdown, but sectors like

IT and pharma are likely to remain unscathed as their business is not

directly linked to federal spending.

"The shutdown of the US government will certainly hit Indian exports because of crippling of the trade facilities at the ports and airports," Assocham President Rana Kapoor said.

The US government today shutdown ¿ for the first time in nearly 18 years - as the Republican and the Democrats failed to strike a deal on spending and budget mainly due to their differences over 'Obamacare', the flagship healthcare

programme of President Barack Obama. Engineering exporters' body EEPC India today said Indian exports to the US face a demurrage threat due to shutdown in the world's largest economy.

"Commercial ports do not come under emergency service category, so there will be a delay in port services like clearing of goods from ports due to staff shortage. This may result in huge demurrage for exporters," EEPC India Chairman Anupam Shah said.

Demurrage is a charge payable to the owner of a chartered ship in respect of failure to load or discharge the ship within the time agreed.

Engineering exports are close to 20 per cent of the total export basket of the country.

However, the shutdown is unlikely to affect sectors like pharmaceutical and IT atleast in the immediate term. "Indian Pharma Industry is not selling drugs to the US

Government. It is selling mostly private. So, the US government shutdown will not have any impact on the India pharma industry," Indian Pharmaceutical Alliance (IPA) Secretary General D G Shah told PTI.

For more, visit :http://www.indianexpress.com/news/us-shutdown-to-hit-exports--pharma-it-see-no-immediate-impact/1177220/

"The shutdown of the US government will certainly hit Indian exports because of crippling of the trade facilities at the ports and airports," Assocham President Rana Kapoor said.

The US government today shutdown ¿ for the first time in nearly 18 years - as the Republican and the Democrats failed to strike a deal on spending and budget mainly due to their differences over 'Obamacare', the flagship healthcare

programme of President Barack Obama. Engineering exporters' body EEPC India today said Indian exports to the US face a demurrage threat due to shutdown in the world's largest economy.

"Commercial ports do not come under emergency service category, so there will be a delay in port services like clearing of goods from ports due to staff shortage. This may result in huge demurrage for exporters," EEPC India Chairman Anupam Shah said.

Demurrage is a charge payable to the owner of a chartered ship in respect of failure to load or discharge the ship within the time agreed.

Engineering exports are close to 20 per cent of the total export basket of the country.

However, the shutdown is unlikely to affect sectors like pharmaceutical and IT atleast in the immediate term. "Indian Pharma Industry is not selling drugs to the US

Government. It is selling mostly private. So, the US government shutdown will not have any impact on the India pharma industry," Indian Pharmaceutical Alliance (IPA) Secretary General D G Shah told PTI.

For more, visit :http://www.indianexpress.com/news/us-shutdown-to-hit-exports--pharma-it-see-no-immediate-impact/1177220/

Should you hire a financial planner or do it yourself

Updated: Sat, Jul 02 2011. 05 21 PM IST

Be it exercising, dieting, curing simple health problems,

building a house, tax filing or money management, there are two ways of

getting them done—hire a professional for guidance or do it yourself.

In each case, the decision to hire a professional is based on many

factors varying for every individual. For example, if you are building a

house on a plot, you may decide to hire an architect based on the size

of the project, the kind of interiors you want and your budget. Else,

you may simply brief a local contractor and supervise the construction

yourself.

Financial planning is no rocket science, it is a

combination of simple financial strategies, few calculations and, most

importantly, discipline. You may not have a written plan and a second

opinion by a certified financial planner (CFP), but can still do fine

doing it yourself if the following five factors are in your favour and

you are disciplined and self-motivated to take charge of your money.

Time: You have to commit “time” if you want to manage money

successfully. You will first need to start by educating yourself with

personal finance matters and products. The best way to do this is by

reading money magazines or money sections of your daily newspaper. You

may also spend time watching television or surf the Internet. There is

too much information floating around, you need to get used to

terminology and products on insurance, investments, banking and

taxation.

You will also need “time” to understand your needs, set

financial goals, learn to use financial calculators (most of them are

available on the Internet), compare products, take a decision and

execute it. Getting a grip over your money is a continuous affair and

doesn’t happen overnight; it will take at least two-three years.

Spending 6-9 hours a month over weekends should serve the purpose.

If you are not able to make this commitment, it’s a good

idea to hire a financial planner who will do the handholding, advise and

maybe even execute the plan. Even in this case you will have to spend

2-3 hours a month in meeting the planner, understanding the plan,

executing and reviewing the plan.

Affordability: Hiring an experienced and professional financial

planner costs money. In India currently, CFPs charge anywhere between Rs

10,000 and Rs 30,000 to make a plan, execute and monitor it. Its no

point having a plan done from self-proclaimed planners who are actually

insurance agents or mutual fund distributors doing it for free and in

the end recommending the products they want to sell.

”Willingness to pay” is best left to you, but “ability to

pay” can be quantified to some extent. You can use this as a benchmark

for deciding whether to hire a CFP or do it yourself. It’s a simple

trade-off—you pay fee to save your time, efforts and get professional

advice, but let this not be the only deciding factor.

For more, visit : http://www.livemint.com/Opinion/NHrreRJCkZqYU1tTWJbjWP/Should-you-hire-a-financial-planner-or-do-it-yourself.html

Thursday, October 10, 2013

Aadhaar card must be voluntary, says Supreme Court

In the middle of a working day, SM Rehman, a daily wage earner,

is at the ration card office in Delhi's Ambedkar Nagar, trying to get a

new ration card made for his family of six. His biggest stumbling block

isn't the form but an Aadhaar card. Under the Delhi government's food

security scheme, an Aadhaar card is required to get a new smart card for

ration.

"I took me 15 days to get my Aadhaar card made, but I'm the only one who has an Aadhaar card in my family," he tells us. The new ration card, will entitle his family to subsidised food under the government's ambitious food security scheme. But the long processes have him worried. "I have already spent 30 days of work for 3 kilos of ration."

Mr Rehman is not alone. Some residents of Sarita Vihar we met at the ration office told us the mantra was simple: no Aadhaar, no ration card. Laxmi said, "They won't accept forms here without an Aadhaar number. Even if you have to add the names of children, they need to have Aadhaar cards too."

The Delhi government has maintained that the registration for

Aadhar or the unique identification number (UID) is voluntary. But by

linking the Aadhaar to the ration card has virtually made enrolling for

the UID mandatory.

Now the government's ambitious unique identity project comes with a word of caution from the Supreme Court. While hearing a petition on its distribution among illegal immigrants, the top court said getting an Aadhaar card must be voluntary and not mandatory.

The Supreme Court which is examining the validity of the Aadhar scheme has passed an interim order today saying no citizen should suffer for want of Aadhaar cards and Aadhaar cards should not be issued to illegal migrants.

After the Supreme Court order the Delhi government told NDTV it will study the top court's decision before revisiting its plan although it feels the Aadhaar has already covered 99 per cent of the population and is being used more as a tool of convenience.

Source : http://www.ndtv.com/article/india/aadhaar-card-must-be-voluntary-says-supreme-court-422675

"I took me 15 days to get my Aadhaar card made, but I'm the only one who has an Aadhaar card in my family," he tells us. The new ration card, will entitle his family to subsidised food under the government's ambitious food security scheme. But the long processes have him worried. "I have already spent 30 days of work for 3 kilos of ration."

Mr Rehman is not alone. Some residents of Sarita Vihar we met at the ration office told us the mantra was simple: no Aadhaar, no ration card. Laxmi said, "They won't accept forms here without an Aadhaar number. Even if you have to add the names of children, they need to have Aadhaar cards too."

Now the government's ambitious unique identity project comes with a word of caution from the Supreme Court. While hearing a petition on its distribution among illegal immigrants, the top court said getting an Aadhaar card must be voluntary and not mandatory.

The Supreme Court which is examining the validity of the Aadhar scheme has passed an interim order today saying no citizen should suffer for want of Aadhaar cards and Aadhaar cards should not be issued to illegal migrants.

After the Supreme Court order the Delhi government told NDTV it will study the top court's decision before revisiting its plan although it feels the Aadhaar has already covered 99 per cent of the population and is being used more as a tool of convenience.

Source : http://www.ndtv.com/article/india/aadhaar-card-must-be-voluntary-says-supreme-court-422675

Soon, apply for passport from your phone

Soon

there will be a smart way to apply for passports. The ministry of

external affairs is in the final stages of launching an app that will

allow people to apply and pay the fees for passports on their mobile

phones.

The new app will be an upgraded version of mPassport Seva that is available for Android, iOS and Windows Phone platforms. mPassport Seva currently allows users to find general information, locate nearest passport centre and police station, calculate fees and track the status of applications. More features like provision to file application and pay fees will be added to it.

The new app will be an upgraded version of mPassport Seva that is available for Android, iOS and Windows Phone platforms. mPassport Seva currently allows users to find general information, locate nearest passport centre and police station, calculate fees and track the status of applications. More features like provision to file application and pay fees will be added to it.

"The facility to help applicants fill passports and make payment

through the app should be available in one to one-and-a-half months,"

said Golok Kumar Simli, principal consultant and head (technology),

ministry of external affairs. Applicants will be able to log in, file

the application and track its status but will have to carry hard copies

of the documents required to the passport seva kendra after an ARN

number is generated and an appointment fixed, he said. Citing security

concerns, he, however, refused to explain how the app will work.

Simli said it was being developed by Tata Consultancy Services which will hand it over to MEA. The development team, comprising 30-40 people, is simultaneously working on other MEA projects. It is part of the Passport Seva Project, which is executed by consular, passport and visa (CPV) division of MEA, and aims at providing passport services to everyone in a speedy and transparent manner.

Applicants appeared elated about the plan. "Presently, even getting an online appointment is a struggle. With the new app, more people will begin applying and I don't think the system will have network issues."

A top official at the regional passport office in the city said they had received a communication about the technical wing working on the new app. "It remains to be seen whether there will be issues on connectivity and network," he said.

Source : http://articles.timesofindia.indiatimes.com/2013-10-08/software-services/42828093_1_passport-seva-project-new-app-mpassport-seva

Simli said it was being developed by Tata Consultancy Services which will hand it over to MEA. The development team, comprising 30-40 people, is simultaneously working on other MEA projects. It is part of the Passport Seva Project, which is executed by consular, passport and visa (CPV) division of MEA, and aims at providing passport services to everyone in a speedy and transparent manner.

Applicants appeared elated about the plan. "Presently, even getting an online appointment is a struggle. With the new app, more people will begin applying and I don't think the system will have network issues."

A top official at the regional passport office in the city said they had received a communication about the technical wing working on the new app. "It remains to be seen whether there will be issues on connectivity and network," he said.

Source : http://articles.timesofindia.indiatimes.com/2013-10-08/software-services/42828093_1_passport-seva-project-new-app-mpassport-seva

Wednesday, October 9, 2013

Cheaper term cover may not be the best deal

You should look at the death claims denial ratio and mortality tables of companies before selecting an insurance policy.

LIC asks IRDA for deadline extension

Life Insurance of India (LIC) has said it has asked the regulator for extending the deadline for withdrawing existing products that do not meet the new norms from October 1.

“We are awaiting approval from the Insurance Regulatory and Development Authority (IRDA). We have made this request in case approvals are not with us. I am sure that IRDA is going to take a call on this and take a decision, which is in the larger interest of investors,” LIC Chairman S K Roy told reporters here on the sidelines of an event organised by Ramakrishna Mission.

According to the regulator, all the existing group products have to be aligned with the new rules before June 30, while individual products have time till September-end.

The new guideline for traditional life insurance will have products with more benefits for policyholders, improve transparency and curb mis-selling of the traditional products.

Under this, IRDA has capped commissions, and provided for minimum sum assured and guaranteed surrender value on traditional products sold by life insurers.

Talking about LIC’s product line Roy said, “Looking at what we are trying to do is that whatever products we have in the bouquet today, we want to have similar products in the restructured versions also. That is our product strategy at this moment. We are planning to file everything that is required to be filed. We are hopeful that IRDA will take a call on this matter.”

Going forward, he said the business growth is healthy and the company is expecting a good growth. “Business outlook is good. July and August have shown good growth. September business so far has also been very good. Overall, we are showing a healthy growth in the business,” he added.

The current quarter has seen growth in the business, but it is difficult to assume the impact of whatever changes have been brought in the restructured products by the regulator at this stage, Roy said.

“Unless the products are rolled out in the market and the distribution arm works on those products, it is difficult to predict the impact of the changes,” he said adding, “However, I am confident that our products will be well accepted by customers.”

Source : http://www.thehindubusinessline.com/industry-and-economy/banking/new-norms-lic-asks-irda-for-deadline-extension/article5182267.ece

Exide looking to sell stake in insurance arm

Exide looks at equity partner for ING Vysya Life Insurance after the exit of ING Group earlier this year.

Industrial battery maker Exide Industries Ltd is looking to bring in an equity partner in its insurance firm, ING Vysya Life Insurance Co. Ltd, following the sale of the ING Group’s interests in all Asian insurance ventures earlier this year.

The insurer is now wholly owned by Exide, after it bought in March the combined 50% stake of its three partners. ING, a Dutch financial services group, held 26% in the firm. The insurer is now looking to issue new shares to expand its capital base for growth, said P.K. Kataky, Exide’s chief executive officer and managing director.

Exide does not intend to sell its own stake immediately though it will get diluted due to the share sale by the insurer, he added.

ING set to exit Indian insurance business

ING Insurance International, the Dutch major, is all set to exit the Indian insurance market.

ING Insurance International, the Dutch major, is all set to exit the Indian insurance market.

The company holds 26% stake in ING Vysya Life Insurance Company.

“ING is definitely looking at exiting, it’s just a matter of time. They are at the moment concentrating on selling the rest of Asia business. Once that’s taken care of, ING will exit from India too,” five sources familiar with the development separately said.

An ING Vysya spokesperson refused to comment saying “it is business as usual at ING”.

One reason for putting the India exit on the backburner is that some issues are left to be ironed out.

For instance, ING Vysya Bank is seeking a bancassurance partnership for distributing insurance products even after the exit of the foreign partner.

“The bank wants to negotiate this with the foreign partners who are lined up for the stake sale ,” said an industry source, requesting anonymity.

“Even Exide wants to exit. And this will lead to greater trouble as they will have to seek both a domestic partner and a foreign partner or go for a merger,” this person said.

Battery major Exide Industries is the largest shareholder in the company with 50% stake.

An Exide spokesperson refused to comment, and another company source said an exit is not being contemplated.

ING has decided to sell off its insurance and asset management business by 2013 as part of a global restructuring plan.

The move will help the company to pay back $7 billion that it received from European Union in 2008. During that financial crisis, the company received $14.6 billion through a bailout plan.

According to Insurance Regulatory Development Authority data, ING Life collected premium of Rs48.79 crore for January this year. In February and March, the mop-ups were Rs62.55 crore and Rs116.96 crore, respectively. The ‘tax-saving’ month, indeed, provided a lot of cheer.

But like all life insurers, business went over a cliff with the start of the new fiscal in April and the premium collection stood at Rs14.09 crore. A major chunk of the business came from individual single and non-single premium collections.

Source : http://www.dnaindia.com/money/1706262/report-ing-set-to-exit-indian-insurance-business

The company holds 26% stake in ING Vysya Life Insurance Company.

“ING is definitely looking at exiting, it’s just a matter of time. They are at the moment concentrating on selling the rest of Asia business. Once that’s taken care of, ING will exit from India too,” five sources familiar with the development separately said.

An ING Vysya spokesperson refused to comment saying “it is business as usual at ING”.

One reason for putting the India exit on the backburner is that some issues are left to be ironed out.

For instance, ING Vysya Bank is seeking a bancassurance partnership for distributing insurance products even after the exit of the foreign partner.

“The bank wants to negotiate this with the foreign partners who are lined up for the stake sale ,” said an industry source, requesting anonymity.

“Even Exide wants to exit. And this will lead to greater trouble as they will have to seek both a domestic partner and a foreign partner or go for a merger,” this person said.

Battery major Exide Industries is the largest shareholder in the company with 50% stake.

An Exide spokesperson refused to comment, and another company source said an exit is not being contemplated.

ING has decided to sell off its insurance and asset management business by 2013 as part of a global restructuring plan.

The move will help the company to pay back $7 billion that it received from European Union in 2008. During that financial crisis, the company received $14.6 billion through a bailout plan.

According to Insurance Regulatory Development Authority data, ING Life collected premium of Rs48.79 crore for January this year. In February and March, the mop-ups were Rs62.55 crore and Rs116.96 crore, respectively. The ‘tax-saving’ month, indeed, provided a lot of cheer.

But like all life insurers, business went over a cliff with the start of the new fiscal in April and the premium collection stood at Rs14.09 crore. A major chunk of the business came from individual single and non-single premium collections.

Source : http://www.dnaindia.com/money/1706262/report-ing-set-to-exit-indian-insurance-business

DLF bids adieu to insurance, sells 74% stake in DLF Pramerica

India’s largest realty firm DLF will exit from life insurance business by selling 74 percent stake in its joint venture DLF Pramerica Life Insurance to Dewan Housing Finance, reportedly for over Rs 350 crore. DLF had in 2007 announced entry into the life insurance business through a joint venture with US insurance giant Prudential Financial’s arm. The joint venture, where the Indian realty firm held 74 percent in the joint venture and the rest was owned by Prudential International Insurance 26 per cent, had reported a combined loss of over Rs 250 crore during past two fiscals.

A man walks past a DLF billboard in Mumbai. Reuters “…the company today signed definitive agreements to sell its 74 percent stake in the life insurance joint venture DLF Pramerica Life Insurance…to Dewan Housing Finance and its group entities,” DLF said in a filing to BSE. Neither of the companies, however, disclosed the value of the deal but sources said it could be worth Rs 350-400 crore.

“These agreements are subject to regulatory approvals. The transaction consideration shall be disclosed post receipt of all such approvals,” it said. “This transaction is in line with our ongoing strategy to divest non-core businesses or assets. We have had a very cordial relationship with Prudential and wish them the best in their new partnership with DHFL,” DLF Group CFO Ashok Tyagi said in a statement. During 2012-13, the company had earned first premium income of Rs 138.64 crore, a 35 percent increase over Rs 102.83 crore in the previous fiscal. At the end of 2012-13, the joint venture completed about four-and-a-half years of operations and had 55 branches in India and a team of 5,487 individual agents.

Read more at: http://www.firstpost.com/investing/dlf-bids-adieu-to-insurance-sells-74-stake-in-dlf-pramerica-986981.html?utm_source=ref_article

Aviva may exit India life insurance business: sources

Aviva PLC (AV.L) may pull out of its Indian insurance joint venture, valued at more than $500 million, as the British insurer retreats from less-profitable markets where it has struggled to expand, people familiar with the matter said.

Aviva, which aims to cut costs by 400 million pounds by year-end, is in the process of hiring corporate advisors to find buyers for its 26 percent stake in Aviva Life, its venture with Dabur Group, the sources told Reuters.

The insurer is considering various options, including selling its stake to Dabur Group if it fails to find a foreign buyer, one of the sources said. Dabur Group owns personal care and food products manufacturer Dabur India (DABU.NS).

Aviva would be the third foreign insurer to quit India since 2012, stymied by regulations that restrict foreign ownership and fierce political opposition to changing those limits.

Aviva declined to comment. Mohit Burman, a director of Aviva Life who represents Dabur Group, was not immediately available for comment. The sources also declined to be identified due to the confidential nature of the matter.

The insurer had identified China and India as "high priority" and "must win" markets, but the move to sell out of India signals a change in that strategy.

Last year, Aviva hired former AIA Group (1299.HK) CEO Mark Wilson to lead a turn around in its business which was hit by slower growth in its main market Europe.

Wilson joined after spiralling costs and poor share price performance triggered an investor revolt in 2012 that forced out then-CEO Andrew Moss. This year, Aviva pulled out of its Malaysian insurance joint venture and exited from Russia.

TOUGH MARKET

Like many other foreign insurers, Aviva rushed into India after the government allowed foreign investment in the $40 billion-plus insurance market in 2000, lured by low penetration rates and the high savings rate in Asia's third-largest economy.

Life insurance penetration in India is about 3.4 percent of gross domestic product in terms of total premiums underwritten in a year, much lower than 8.8 percent in Japan and 8.7 percent in Britain.

Regulatory uncertainty, however, has proved tough for foreign insurers while insurance in general has failed to take off as expected among the public - the whole industry logged an accumulative $3 billion loss over the last decade.

Indian laws limit foreign ownership in domestic insurers to 26 percent. Government approval for a proposal to raise the limit to 49 percent has been pending for a long time due to opposition by nationalist politicians.

Insurers were also hit by a 2010 clamp-down on the sale of lucrative equity-linked products. Foreign firms remain overshadowed by state-owned Life Insurance Corp of India, which holds an almost 75 percent market share.

Source : http://in.reuters.com/article/2013/08/05/aviva-india-dabur-idINDEE97406Y20130805Card Protection Plan-Insure your Debit and Credit Cards

Suppose you are carrying multiple credit/debit cards in your wallet and lost it then what will be your situation? It may happen to all of us. It is such a situation that scares all of us as lost cards may be utilized to any extent causing huge financial burden. The solution to this will be having an insurance cover for your debit or credit cards from the Card Protection Plan.

This plan is best suitable for persons who uses multiple credit/debit cards, keep all of them in their wallet all the time, frequent traveler or chances of losing/misplacing are high. CPP or Card Protection Plan is a comprehensive plan which protects card in the event of card loss, theft and related fraud. This product is designed to help you safeguard all your Credit, Debit and ATM Cards. If you loss the card then you can use their 24 hour helpline number and inform the same. Once you report them then CPP will inform all card issuers to cancel the cards as they lost. Let us see few benefits of this service.

Benefits-

- One call is enough to block all your cards.

- If you are registered your car or bike break downs, CPP will assist by providing roadside assistance service. But do remember that this service will be available with selected cities in India and also within 50 km range of cities.

- In case you lost the cash along with cards then CPP will provide you the emergency cash assistance of Rs.20,000. This advance is interest free and you need to repay it within 28 days.

- In case you lost the PAN card along with cards then CPP will facilitate free PAN card replacement. They will coordinate on behalf of you in getting PAN card.

- If you register your mobile phone with them and you lost then CPP will help you in blocking SIM.

Few Conditions you must know-

- This facility is available to Indian resident whose age is above 18 years.

- You need to report of loss within 24 hours of discovering the card loss.

- You can cancel the service within 30 days of buying. If you do so then they will refund the amount.

Plenty of Indian Card issuers have tied with CPP and few of them are as below.

Currently CPP offers three plans which are called 1) Classic-Rs.1,145+Taxes, 2) Premium-Rs.1,495+Taxes and 3) Platinum-Rs.1,745+Taxes.

Monday, October 7, 2013

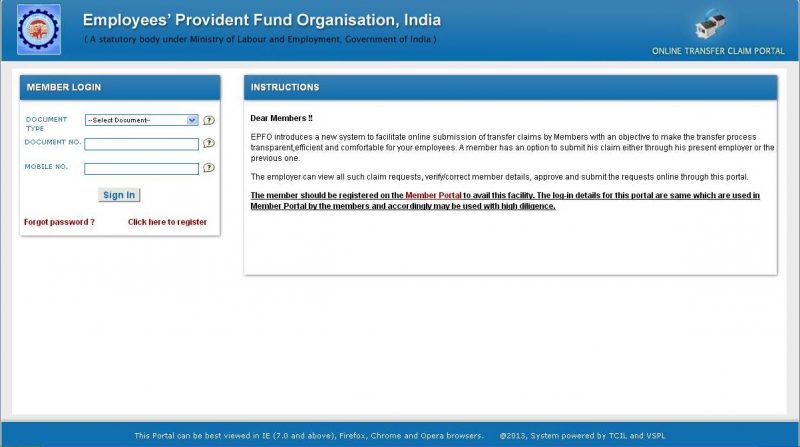

EPF Online Transfer Claim Portal (OTCP) -Transferring is now online !!!

Recently EPFO (Employees’ Provident Fund Organisation) started online transfer of your old employer EPF account in new EPF employer account online. I hope with this initiative lot of hurdles of the EPF members will get resolved. Let see the procedure and guidelines of this account transfer.

The first step before proceeding to apply for online transfer is, you must have an online registered account on EPFO site. To do registrations follow the process provided “HERE“. Once your account is registered then you need to apply for transfer of account by first visiting the Online Transfer Claim Portal (OTCP) portal.For detailed instruction of how you can apply for transfer visit “HERE” where they provided the detailed instruction of applying.

Few points you must know before proceeding this online apply.

- You must be a registered member of the EPFO portal before proceeding.

- Both your previous employer as well as present employer must be available on EPFO database.

- The employer must register for the digital signature process of EPFO.

- You can check your eligibility for transfer by visit OTCP site ”Here“.

- You can’t edit any of your personal details as well as the details like joining or exit dates.

- But suppose if you found any discrepancy in the details then you can do editing so by clicking the tab called “The following information in incorrect”. Once you do the editing, take the printout of the pdf form. Self attests the same you need to submit it to the EPFO office through your current employer.

- You can submit for transfer once these rectifications are done properly.

- You can change your DOB (date of birth) also but the restriction of attempting to change is only about 3 times.

- If both your previous as well as current employer registered digital signatures with EPFO then you can submit this claim form either with previous or current employer for employer attestation.

- Even if your previous employer registered with EPFO then too you can submit form with either of them.

- If your previous employer not registered then also you can submit with either of them but it will take time to transfer as the process of verification data will be done.

- You can submit online transfer only in case your previous employer registered with EPFO for digital signature.

- The same way your present employer registration also mandatory for online transfer.

- Once online submission is done, you need to take the printout of the same and submit it with employer with self attestation.

- You have the option to choose for submitting your form for attestation either with previous or current employer.

- Within 15 days of online submission you need to submit claim form with your employer.

- If any rejection from the employer then it will be after 15 days only.

- You can view the status of claim online also.

- Below are the few reasons for rejecting your claim.

- The claim already submitted previously and EPFO not yet rejected it.

- You have not submitted the signed online claim transfer form with your employer within stipulated 15days period.

- Records mismatch.

- Signature mismatch.

Friday, September 27, 2013

FM has asked Life Insurance Corporation of India to appoint board members in 50 companies

NEW DELHI: The Finance Ministry has asked Life Insurance Corporation of India to appoint board members in 50 companies in which it has a stake and no representation.

The insurance behemoth has stakes in about 123 companies, of which it has board members in 73 firms, while there is no representation in 50 companies, a senior Finance Ministry official said.

http://

Subscribe to:

Posts (Atom)